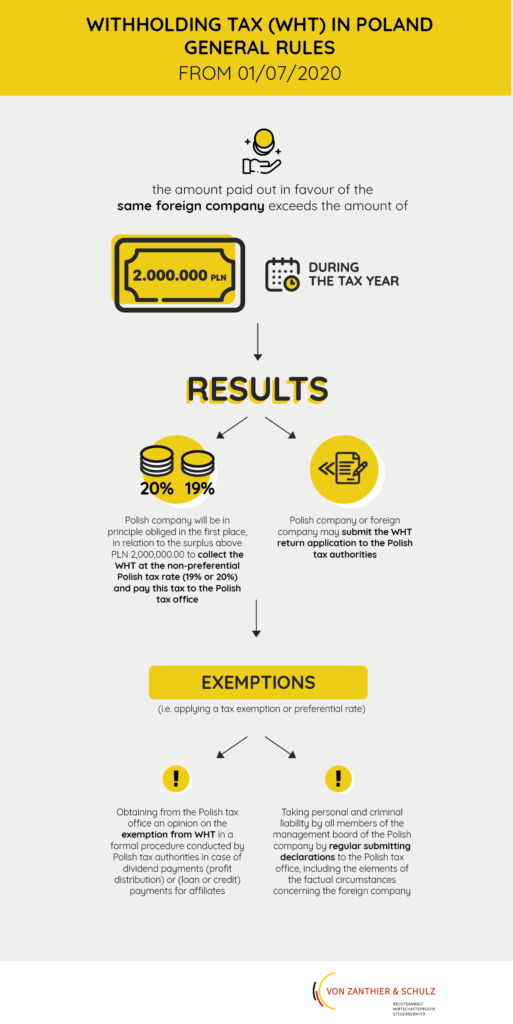

WHT in Poland – how general rules from 01/07/2020 will look like? We explain this important issue in our infographic from the WHT series. We will be happy to answer your questions.

Case: The amount paid out in favour of the same foreign company exceeds the amount of PLN 2,000,000.00 during the tax year.

Results:

- Polish company will be in principle obliged in the first place, in relation to the surplus above PLN 2,000,000.00 to collect the WHT at the non-preferential Polish tax rate (19% or 20 %) and pay this tax to the Polish tax office;

- Polish company or foreign company (depending on who borne the economic burden of the tax) may submit the return application in a formal procedure conducted by Polish tax authorities.

Exemptions to the payment of tax at a non-preferential rate (i.e. applying a tax exemption or preferential rate):

- obtaining an opinion on the exemption from WHT in a formal procedure conducted by Polish tax authorities in case of dividend payments (profit distribution) or (loan or credit) payments for affiliates;

- taking personal and criminal liability by all members of the management board of the Polish company by regular submitting declaration by the Polish tax office.

Authors:

Łukasz Dachowski, LL.M., attorney at law (PL)/tax advisor (PL)/Partner

Magdalena Stefaniak-Odziemska, tax advisor (PL)